Chapter 1: Public Sector Revenue - Government Expenditure and Revenue in Scotland (GERS): 2018 to 2019 - gov.scot

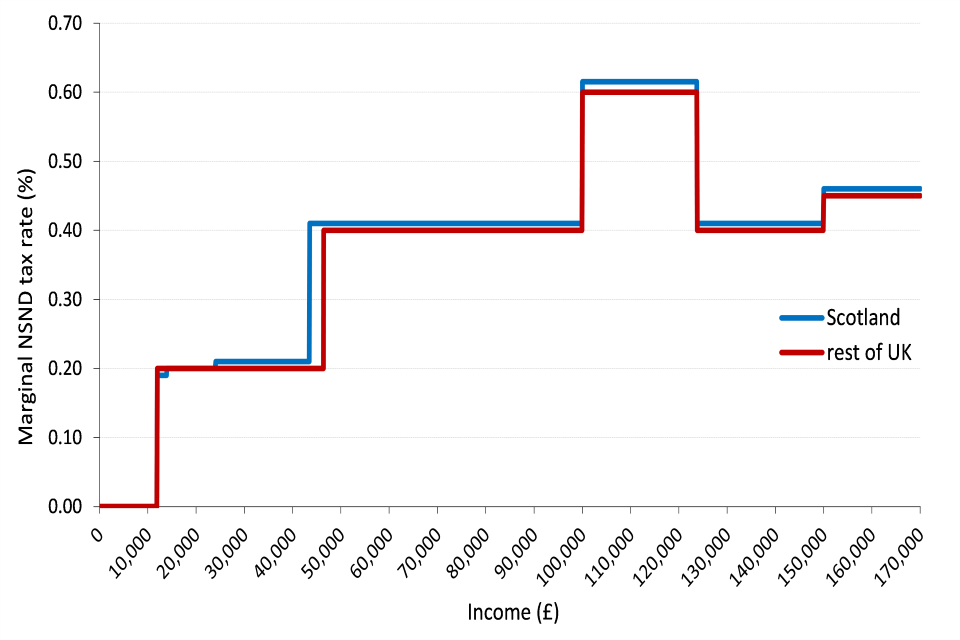

Estimating Scottish taxpayer behaviour in response to Scottish Income Tax changes introduced in 2018 to 2019 - GOV.UK

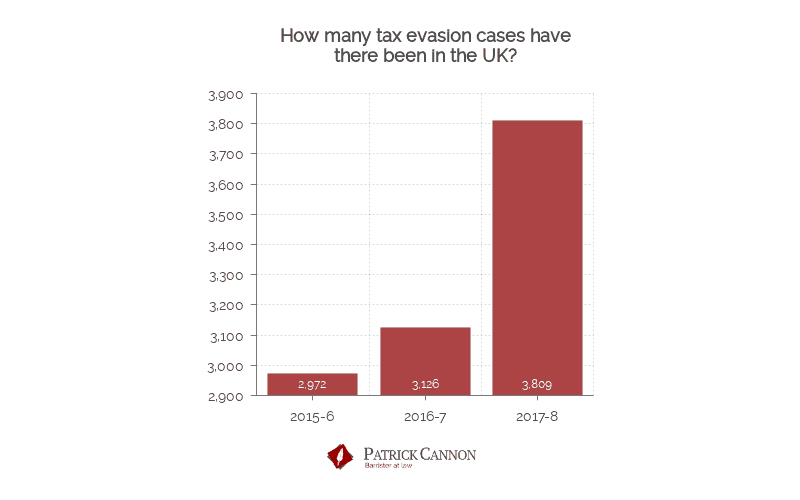

Tax Policy Associates report: UK taxpayers have £570bn in tax haven accounts, and HMRC has no idea how much of this reflects tax evasion – Tax Policy Associates Ltd

Northern Ireland environmental statistics report – Useful Data for Irish River Conservation / Water Quality

Publication of Department for Infrastructure Driver, Vehicle, Operator and Enforcement Statistics 2018-19 Q3 | Northern Ireland Executive

DfI Driver, Vehicle, Operator, and Enforcement Statistics - 2019-20 Quarter Four | Department for Infrastructure

NISRA - The Northern Ireland Road Safety Partnership 2019 Annual Report was published today and is available at https://www.nisra.gov.uk/publications/ northern-ireland-road-safety-partnership-statistical-report-2019 | Facebook

DAERA Statistics on Twitter: "Northern Ireland local authority collected municipal waste management statistics April to June 2019 quarterly report released today. The full report is available at: https://t.co/gtKMOlMXp2 @NISRA https://t.co/MfEhie8xue ...