NPV, Discounted Pay Back Period, IRR, PI | Non- Discounted Cash Flow Techniques| Investment Decision - YouTube

CAPITAL BUDGETING: decision methods - PBP, DPBP, ARR, NPV, PI, IRR, MIRR (theory and interpretation)... eBook : SEKHAR, CHANDRA : Amazon.in: Kindle Store

CAPITAL BUDGETING: decision methods - PBP, DPBP, ARR, NPV, PI, IRR, MIRR (theory and interpretation)... by Chandra Sekhar | Goodreads

CAPITAL BUDGETING DECISIONS: PBP, DPBP, ARR, NPV, PI, IRR & MIRR (Theory & interpretation Book 1) eBook : Sekhar, Chandra: Amazon.in: Kindle Store

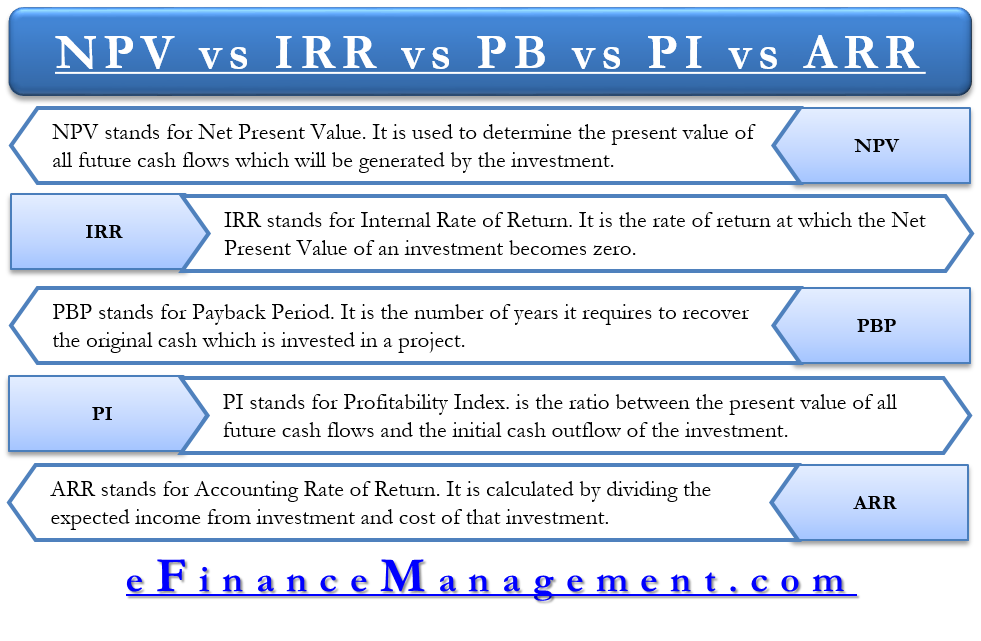

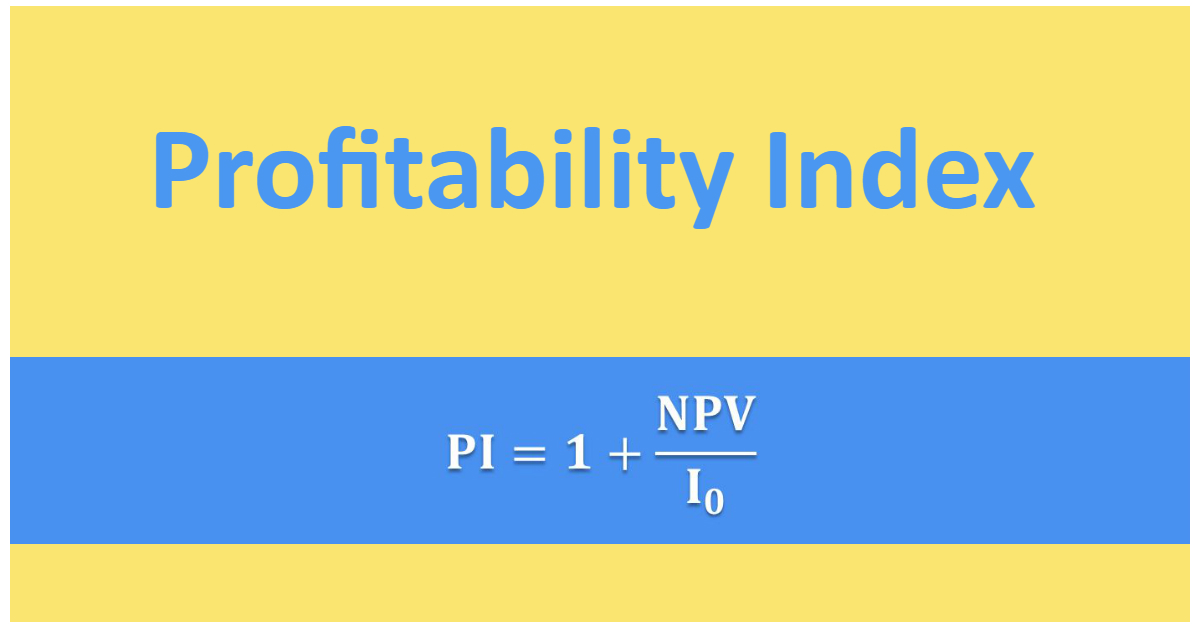

SOLVED: Activity 19 Capital Budgeting:IRR,MIRR,PI The purpose of this assignment is to practice capital budgeting via IRR, MIRR, PI and cross-over rate calculation. Group Number Class meeting Morning/ Afternoon You are (again

Comparison of wind farm NPV, IRR, and PI with investment costs, for... | Download Scientific Diagram

:max_bytes(150000):strip_icc()/NPVFormula-5c23ea8f46e0fb00013d2624.jpg)